Elon Musk, CEO of Tesla, has shared his thoughts on how a potential Donald Trump presidency might affect his company and its competitors. During a call with financial analysts, Musk was asked about the possible consequences of a Trump win, especially in light of Trump’s plan to eliminate federal tax credits for electric vehicles (EVs).

Musk admitted that such a move would have a significant impact. “I guess there would be some impact,” he said. “It would be devastating for our competitors, and it would hurt Tesla slightly.” Despite his strong political support for Trump, Musk acknowledged that changes to tax credits could affect Tesla’s market dynamics.

Trump has also proposed heavy tariffs on cars made in Mexico. This has led Tesla to reconsider its plans for a new factory in Monterrey, Mexico, which was set to open in 2026. “If that’s going to be the case, we kind of need to see how things play out politically,” Musk said, highlighting the uncertainty surrounding these potential policies.

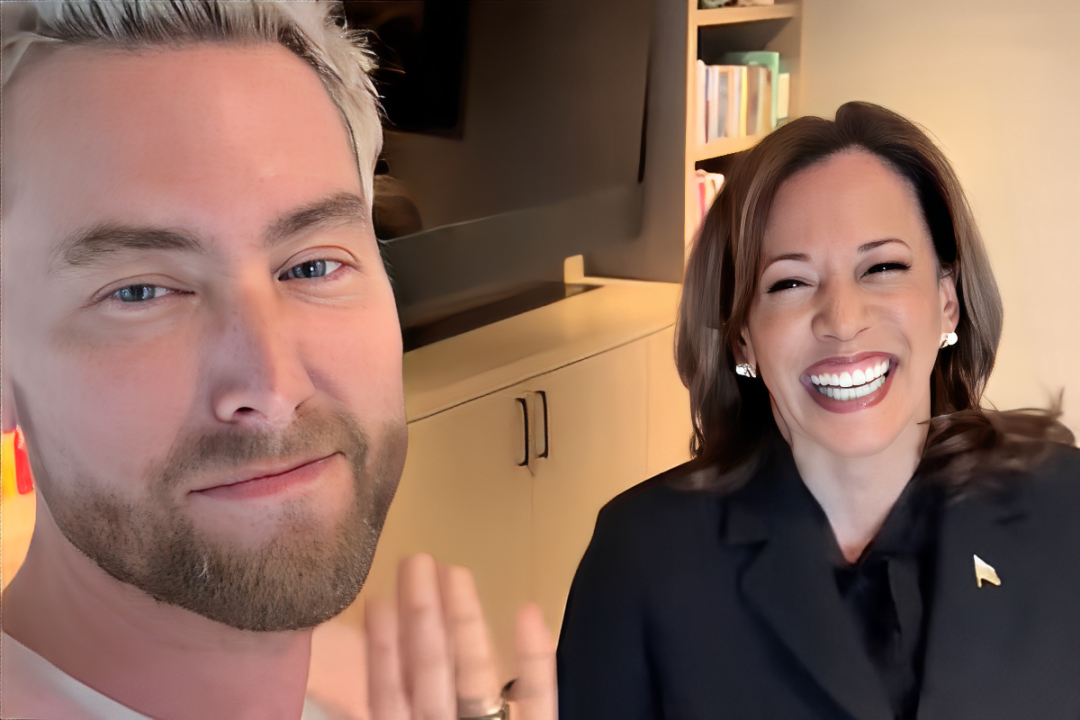

Before the earnings call, Wedbush Securities tech analyst Dan Ives noted that a Trump presidency might negatively impact the EV market. This is because Trump could potentially eliminate the Inflation Reduction Act, which provides tax credits for EVs and certain plug-in hybrids. In contrast, an administration led by Kamala Harris, the presumptive Democratic nominee, might be more favorable for the EV industry.

However, Ives also suggested that Trump could benefit Tesla’s growth strategy, particularly in the area of full self-driving and autonomous vehicles. Musk’s bold vision for Tesla includes a fleet of self-driving robotaxis, which could see fewer regulatory hurdles under a Trump administration.

Despite this, Musk dismissed concerns about regulatory risks, especially compared to General Motors (GM). GM had paused production of its autonomous Origin vehicle due to regulatory challenges. The Cruise Origin, unlike traditional cars, lacks manual controls like a steering wheel and pedals, which are currently required by safety regulations.

“The real reason they canceled it is because GM can’t make it work,” Musk claimed, criticizing GM’s technology. He argued that blaming regulations was misleading, suggesting that the actual issue lay with GM’s capabilities.

In response, GM’s Jim Cain countered Musk’s statements, emphasizing that the Cruise Origin faced significant regulatory hurdles. “All of those statements are categorically false,” Cain said. He explained that the Origin needed a special safety waiver due to its unique design and lack of manual controls. Cain also highlighted that GM’s technology continues to advance, with over 5 million fully autonomous miles driven, contrasting with Tesla’s zero miles of fully autonomous driving.

Musk remains confident in Tesla’s ability to achieve full autonomy despite recent challenges. Tesla’s financial results showed a 45% drop in net profits for the second quarter, marking its second consecutive quarter of declining earnings. Additionally, Tesla’s sales in California fell by 24% in the same period.

Trump has pledged to dismantle what he calls the “green new scam” and eliminate the electric vehicle mandate on his first day in office. According to Ives, if autonomy is key to Tesla’s future, less regulation under a Trump presidency could be advantageous compared to a Harris administration.

Also Read:

- Eli Crane’s Investigation Reveals Potential Security Failures During Trump Rally Shooting!

- 2024 Polls: Kamala Harris’ Battle with Trump and What It Means for Democrats!

- Trump’s Plan to Eliminate Income Taxes: How Will It Impact Your Gas Prices?

Ives believes that the future of Tesla might hinge on its ability to excel in robotics and full self-driving technology. Achieving these goals could potentially push Tesla’s valuation to $1 trillion or even $2 trillion, making it a significant player in the market.