To find owners with dubious statuses, Tarrant assessment officials are using an independent contractor instead of requiring all homestead exemption holders to reapply every five years.

-

-

Last week, FOX 4 shared a story about a Texas law requiring all homeowners to re-apply for their homestead exemption every five years.

-

Rather than having homeowners go through that process, Tarrant County is taking a different approach.

-

The county is only contacting homeowners whose exemption status is questionable.

-

If you get a letter asking you to provide proof of your homestead exemption status, you still shouldn t ignore it. Those who do, risk losing their exemption and paying more.

-

-

Last week, FOX 4 shared a story about a Texas law requiring all homeowners to re-apply for their homestead exemption every five years.

-

Rather than having homeowners go through that process, Tarrant County is taking a different approach.

-

The county is only contacting homeowners whose exemption status is questionable.

-

If you get a letter asking you to provide proof of your homestead exemption status, you still shouldn t ignore it. Those who do, risk losing their exemption and paying more.

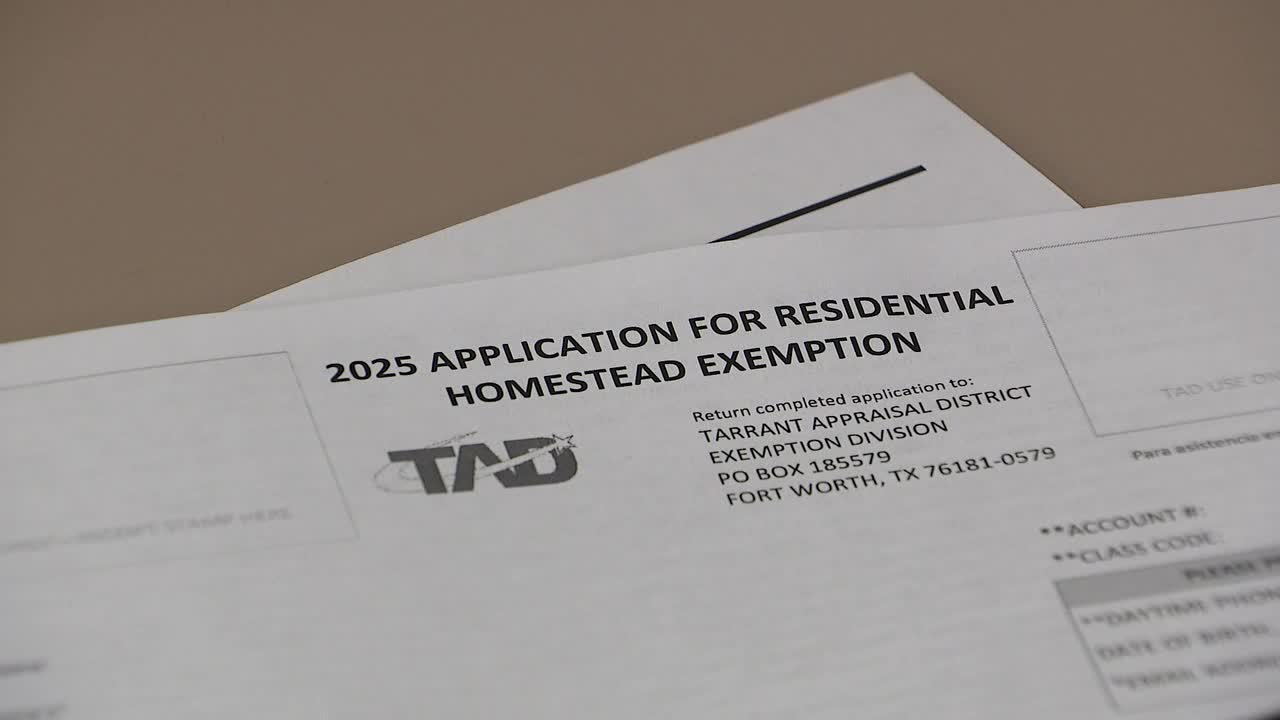

Texas’s Fort WorthAt the Tarrant Appraisal District Office, the clerks have been very busy.

This is due to a new state statute that mandates counties audit homestead exemption holders every five years.

Last week, FOX 4 covered the little-known law.

Many property owners are now looking for clarification.

Additionally, TAD is working to dispel misunderstandings, at least for residents in Tarrant County.

Texas homeowners must now verify homestead exemptions every 5 years or risk losing it

Don’t disregard a letter from your assessment district requesting that you confirm your homestead exemption. If they don’t reply, they risk losing their exemption and having to pay more in taxes. This is what you must do.

What is a homestead exemption?

Texas homeowners benefit from what is known as the homestead exemption. It permits your taxes to be computed at a rate that is less than your market or appraised value.

Most people used to set it and forget it until recently.

In 2023, however, state lawmakers enacted a legislation requiring Texas counties’ assessment districts to assess your eligibility for that exemption at least once every five years.

Tarrant County taking a different approach

Some homeowners who claim the exemption are actually ineligible for it, according to TAD.

According to Tarrant Chief Appraiser Joe Don Bobbit, “there are currently around 30,000 that have hit on radar that may not qualify that we have to look into.” Typically, around 1% are in fact incorrect. That sounds like very little. However, it typically costs the entities millions of dollars.

To find owners with dubious statuses, Tarrant assessment officials are using an independent contractor instead of requiring all homestead exemption holders to reapply every five years.

“At the moment, there is a lot of uncertainty between Tarrant County and Dallas County. They’ve heard that everyone must reapply. According to the legislation, you must essentially validate your homestead once every five years. For Tarrant County residents, we’re attempting to lessen or eliminate that burden as much as possible, and we only ask them to reapply if we believe they are no longer eligible,” Bobbitt stated.

What they’re saying:

On Monday, David Lube came to TAD to confirm his condition.

“It’s unclear. However, I have my small letter, so I’m all right,” he remarked.

Owners of real estate in Tarrant County who receive a letter similar to Lube might only need to confirm that they occupy the exempted property.

The homestead exemption may be terminated if two mailings are disregarded.

“They can determine whether someone have died or whether they live somewhere else. Additionally, they can examine mailing addresses, voter registration, and automobile registration. Therefore, if it appears that someone lives somewhere other than our house, we can do additional research to determine where they truly reside,” Bobbitt stated.

How to check the status of your homestead exemption

What you are able to do:

By visiting the website of their county’s appraisal district, homeowners can verify the validity of their homestead exemption.

Here is a list of all the websites for the county appraisal districts: https://comptroller.texas.gov/taxes/property-tax/county-directory/.

Which exemptions are valid should be found with a short property search.

You will probably be required to pay taxes on the higher assessed value if your status is removed. However, if you are qualified, you can petition for a reimbursement of the difference by getting in touch with your county’s appraisal department.

The Source: Previous news coverage and interviews conducted at the Tarrant Appraisal District Office provided the information for this report.