Homeowners in Idaho have until December 20th to pay their property taxes.

Property taxes can be paid in full or in two installments under Idaho law. If property taxes are paid in two installments, the first half must be paid by December 20. If the first half was paid in full, there is a grace period until June 20 to pay the second half without incurring interest or penalties.

The Ada County Treasurer’s Office states that late fees and interest are applied to the outstanding sum if the first half of property taxes is not paid in full by December 20.

Property taxes are often paid automatically by many mortgaged homeowners as part of their regular mortgage payments. Homeowners can contact their local county treasurer’s office or their mortgage provider if they have any questions about how to pay their property taxes.

Many homeowners in Idaho are receiving their property tax notices this week because county treasurers are mandated to mail them by the fourth Monday in November.

GET THE HEADLINES FOR THE MORNING.

House Bill 292 in Idaho offers a credit for property tax reduction.

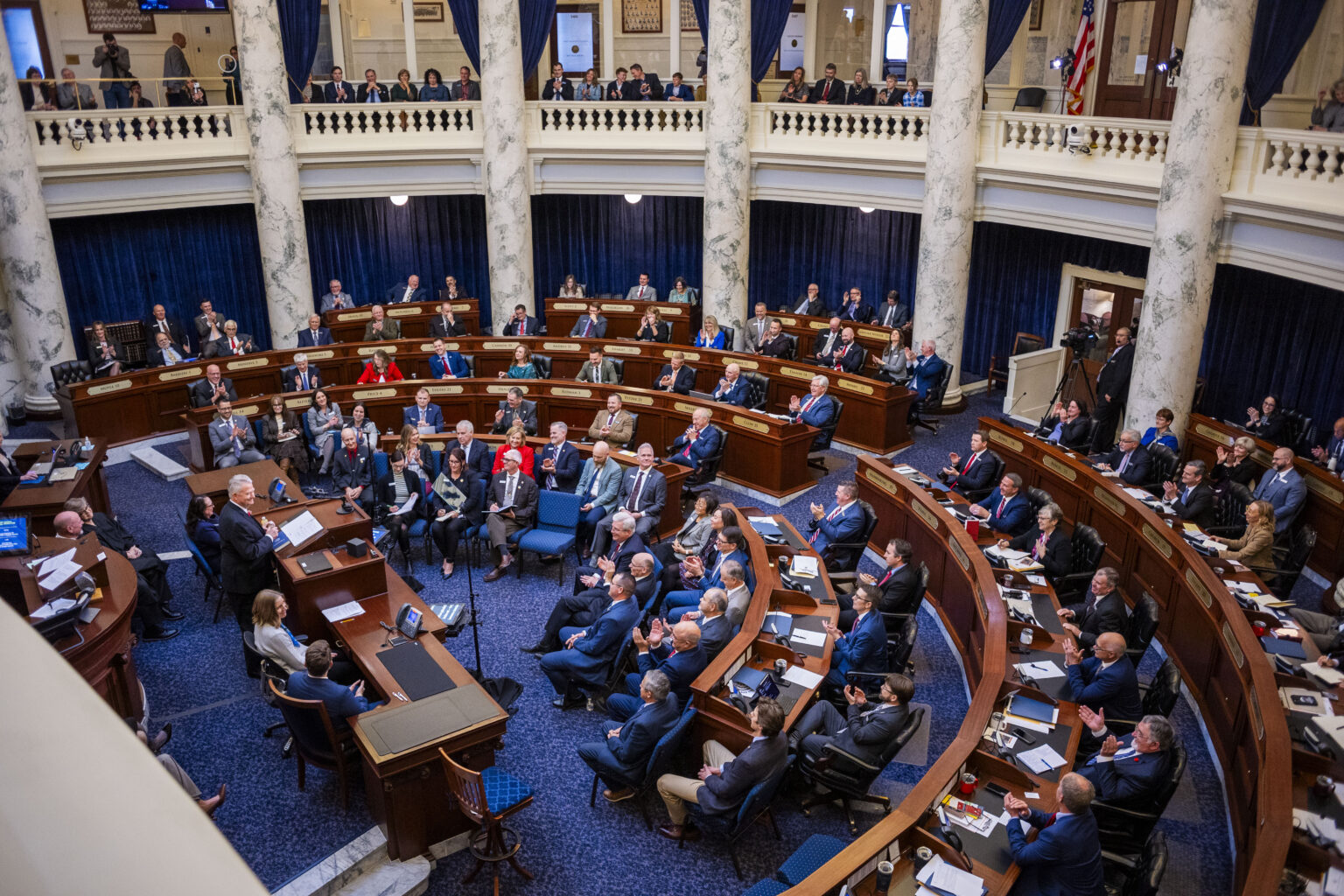

During the 2023 legislative session, the Idaho Legislature passed House Bill 292, which lowered property taxes. The homeowners property tax relief credit is a credit that is automatically applied to the property tax bill of homeowners of owner-occupied properties who obtained the homeowners exemption by the July deadline. House Bill 292 calls for the implementation of a surplus-eliminator, which uses a state budget surplus to reduce property taxes.

However, the Idaho Capital Sun previously reported that the state was unable to identify an additional $14.5 million in revenue by the deadline for that money to go toward reducing property taxes this year due to reporting and reconciliation issues with the state’s massive IT, HR, finance, procurement, and business system, Luma, when state officials went to reconcile the fiscal year 2024 books in July. As a result, instead of the approximately $91 million that could have been used to lower taxes, the state only allocated $76 million of its surplus revenues to property tax reductions this year.

According to state budget officials, the $14.5 million will be applied to any possible budget surplus for the following year as a result of the missed deadline.

Ada County property taxes can be paid by mail at the Ada County Courthouse, 200 W. Front St., over the phone at 844-471-7324, or online at adacounty.id.gov/treasureror. There are fees associated with using a credit or debit card both online and over the phone.To confirm payment alternatives, homeowners in other Idaho counties can contact the treasurer’s office in their community.

OUR WORK IS MADE POSSIBLE BY YOU.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!