A plan that aims to lower Idaho’s corporate and individual income tax rates from 5.695% to 5.3% is making its way to the Idaho House of Representatives floor.

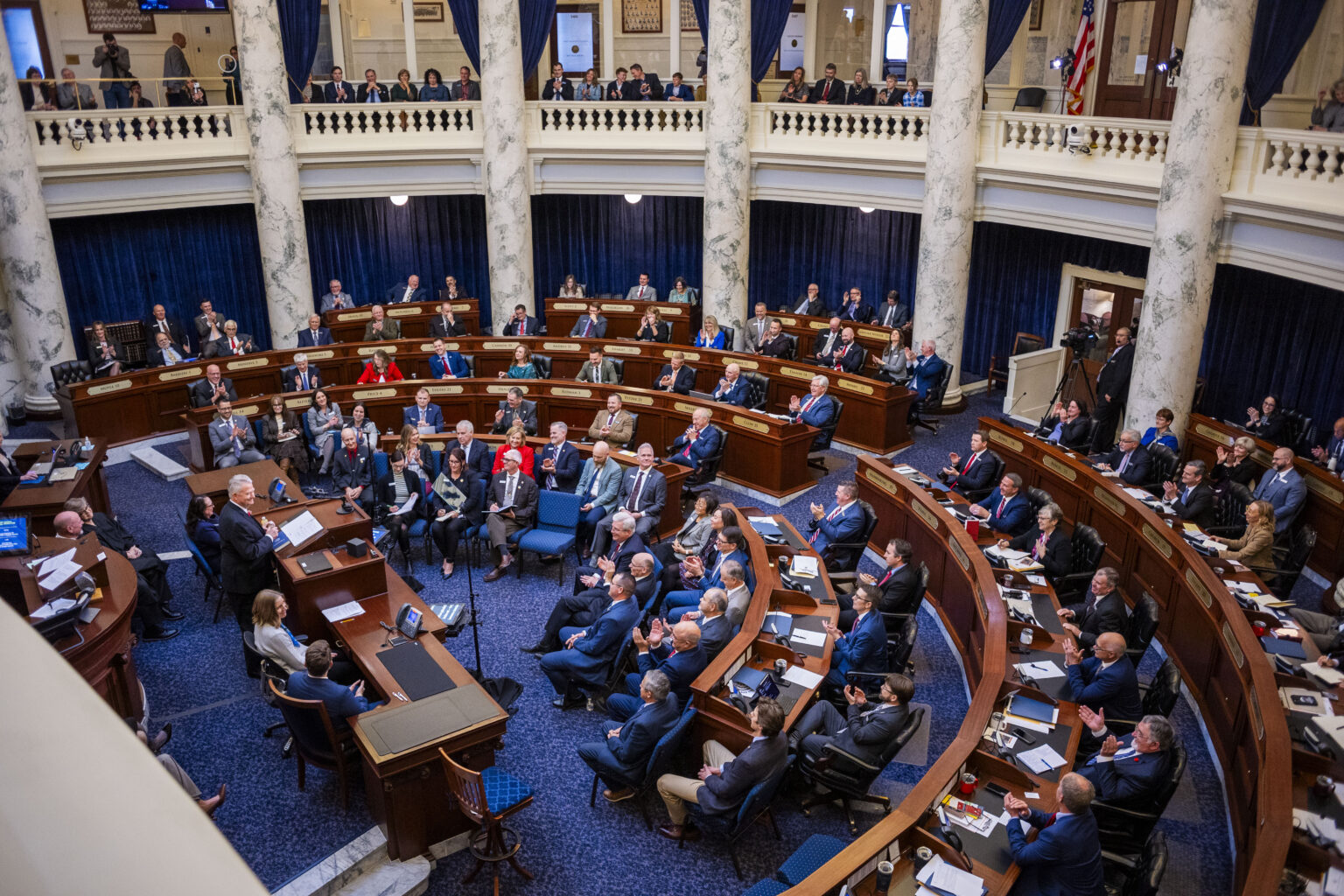

House Speaker Mike Moyle, a Republican, is the sponsor of House Bill 40, which was approved by the House Revenue and Taxation Committee of the Idaho Legislature on Thursday.

Moyles is attempting to lower taxes by about $400 million this year by combining three legislation, including House Bill 40.

At the Idaho State Capitol in Boise on Thursday, Moyle stated, “Every year I bring a tax relief bill, as you are all aware.” My sole motivation for running for the Legislature was to lower taxes, as those of you who know me well are aware. This is most likely the biggest income tax break we have ever given Idaho residents.

Rep. Steve Berch, a Democrat from Boise, opposed the plan, stating that he was unsure if the state could afford to decrease taxes by almost $400 million while still covering all of the state budget and maintaining deferred repairs at public schools.

To ascertain whether we can actually pay this measure, we do not yet have a budget or a revenue figure, Berch stated. We are uncertain about the future of the more than $6 billion we receive from the federal government in light of the Department of Government Efficiency, DOGE, and other executive directives. That can make a big difference.

The independent Idaho Center for Fiscal Policy estimates that a family in Idaho making between $55,000 and $91,000 would receive a tax cut of roughly $127 under House Bill 40.According to the Idaho Center for Fiscal Policy, the top 1% of Idaho earners who make $738,300 or more would enjoy a tax savings of almost $5,358.

Capital gains tax on the selling of gold bullion is likewise eliminated by the income tax reduction measure.

House Bill 40 lowers the corporate and individual income tax rates and makes two other adjustments.

-

It expands the income tax exemption for military pensions.

-

It eliminates the capital gains tax on the sale of gold bullion.

Moyle said that the removal of the capital gains tax on sales of gold bullion was intentional.

During Thursday’s hearing, Moyle stated, “We’re doing that because, quite frankly, we all know that nobody’s paying taxes on it anyway.” We are unable to track it. Additionally, we are taking this action because Idaho is a resource-rich state and we would like to promote greater commercial activity related to those resources here.

According to Idaho campaign finance records, the Sound Money Defense League, based in North Carolina, contributed $44,786 to Moyle’s 2024 reelection campaign. According to campaign finance records, the organization that gave the most money to support Moyle was the Sound Money Defense League, which claims on its website that it wants to return gold and silver to their historic status as America’s constitutional currency.

Idaho’s gold and silver tax legislation are highlighted on the Sound Money Defense League’s website, which also states that it is collaborating closely with lawmakers and in-state partners to offer alternatives to the Federal Reserve’s harmful inflationary monetary policy.

further than Moyle, no further contributions from the Sound Money Defense League to Idaho political candidates are mentioned in campaign finance records.

Three tax-cutting legislation have been introduced in the Idaho House of Representatives in recent days, the first of which is House Bill 40.

By transferring $50 million to the state’s homeowners property tax relief fund one time and an additional $50 million annually to support local school construction and renovation projects that would otherwise be financed by property taxes, House Bill 74 aims to lower property taxes.

House Bill 61 would raise Idaho residents’ annual grocery tax credit from $120 to $155.

The House Revenue and Taxation Committee recommends that House Bill 40, the income tax bill, be passed, and it is headed to the Idaho House of Representatives floor.

OUR WORK IS MADE POSSIBLE BY YOU.